National Conversations Impact Our Community: Part 1

With each passing day, many of us find ourselves asking what the standard for the “new normal” is. But just when we get to a point where we think a line has been established, it inevitably gets crossed. The steady stream of heated rhetoric and controversial tweets make many us want to tune it all out, change the channel, turn off the radio, or unfollow some of our friends on Facebook. At ACRS, we’ve spent almost four and a half decades keeping an eye on, participating in, and leading hard conversations that are taking place here in Seattle and all the way to the other Washington.

The Asian American and Pacific Islander experience here in the United States has historically been one of exclusion and invisibility, from overt policies and legislation like the Chinese Exclusion Act of 1882, to more subtle forms like the raging national debate on DACA and immigration ignoring the fact that Asia sends more immigrants to our country now than does any other region of the world. People from our countries of origin endure some of the longest backlogs in immigration processing, which keeps families apart and puts dreams on hold. Based on the latest available data, the Center for Migration Studies estimates that there were more than 1.7 million undocumented AAPIs in our country as of 2015.

According to the U.S. Department of Health & Human Services, over 1.9 million Asian Americans and Pacific Islanders across the country “gained access to new options for health care coverage” since the passage of the Affordable Care Act (ACA), better known as Obamacare. Washington State’s decision to participate in the ACA’s Medicaid expansion meant that in 2016 alone, over 18,000 AAPIs here were able to gain health care coverage, based on data from the state’s Office of Financial Management.

The battle to repeal and replace the ACA took center-stage for a large part of 2017, but was defeated by razor thin margins each time it got close. These defeats were temporary victories for millions of people, including AAPIs currently receiving health care coverage through Obamacare as Congress turned its attention to the national budget and tax reform.

The National Budget

In May 2017, President Trump issued a budget that outlined his plans for the nation for 2018 and the decade beyond. In early October, the House of Representatives and the Senate released their own budget proposals. All three share two key features: 1) tax cuts and 2) budget cuts.

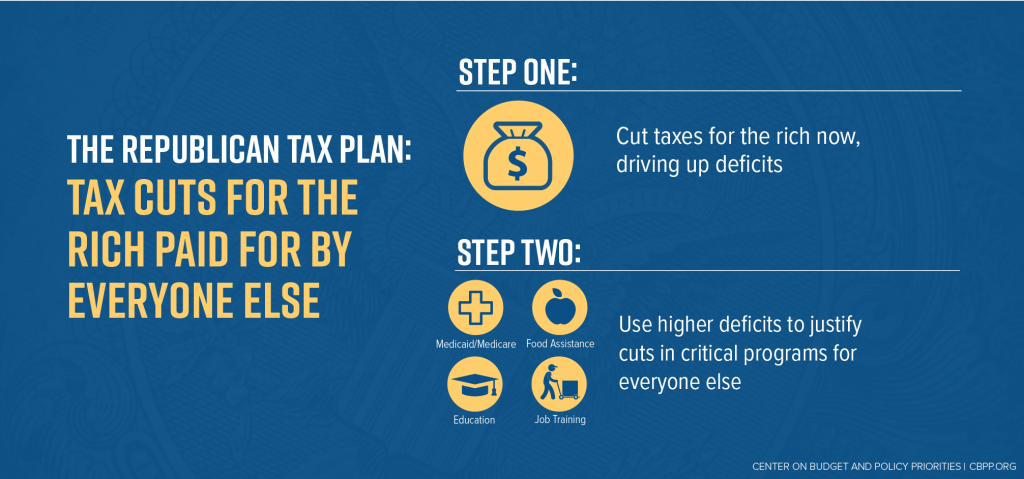

In its analysis of the tax framework that the White House and House and Senate Republicans unveiled in late September, the Tax Policy Center concluded that “those with the very highest incomes would receive the biggest tax cuts…about 80 percent of the total benefit would accrue to taxpayers in the top 1 percent.” The Center for Budget and Policy Priorities (CBPP) goes a step further to point out that the “bottom 80 percent of Americans [those making less than about $150,000] would receive just 13 percent of the benefits.”

CBPP published an analysis in mid-October concluding that although they “[differ] in detail, the three plans are broadly similar.” Here are the key features highlighted in their report that directly impact ACRS and the communities we serve:

- Deep cuts in non-defense appropriations. K-12 education, infrastructure, medical and scientific research, environmental protection, low-income housing, national parks and a myriad of other services.

- Very deep cuts in health care. Each plan would trim Medicaid, Medicare and the ACA’s subsidies for health insurance and health-related programs between $1.8 to $2 trillion. The Congressional Budget Office (CBO) estimates that this would cause millions of people to lose health coverage, raise premiums and weaken coverage, and ultimately contribute to the collapse of the health insurance exchanges set up as part of the ACA.

- Deep cuts in other entitlement programs. Each of the plans would take crucial funds away from social programs that support low and middle-income families, seniors and the disabled, including SNAP (formerly food stamps), Temporary Assistance for Needy Families (TANF), Supplemental Security Income (SSI) and funds for higher education, including Pell Grants and student loans.

What’s next? A single budget document has yet to emerge, so there is still much to be done before a bill reaches President Trump’s desk. CBPP’s assessment of the House tax plan released on November 2 was that it was “more of the same,” citing that its focus on cutting taxes for corporations and the wealthy would substantially increase the national deficit, which would later be used to justify slashing programs and services that serve working and middle-class families. Their November 22 review of the Senate plan highlights a similar focus on cutting taxes for corporations and the wealthy at the expense of low and moderate income Americans.

Check out this interactive map of impact by state.

You Can Help by Joining the Conversation

As we have always done for almost four and a half decades, ACRS and our community partners are taking part in the ongoing debates on health care, funding for programs, immigration and more. We are organizing so that we’ll be ready to tackle the threats to our community and protect the most vulnerable among us. Your voice matters. Please call the Congressional Hotline at (202) 224-3121 to let your representatives and senators know how you feel about these critical issues and how the proposals and actions on immigration and the budget impact our community.

This post is the first of a two-part series on how conversations at the national level impact our community. Tune in next week as we take a look at immigration.